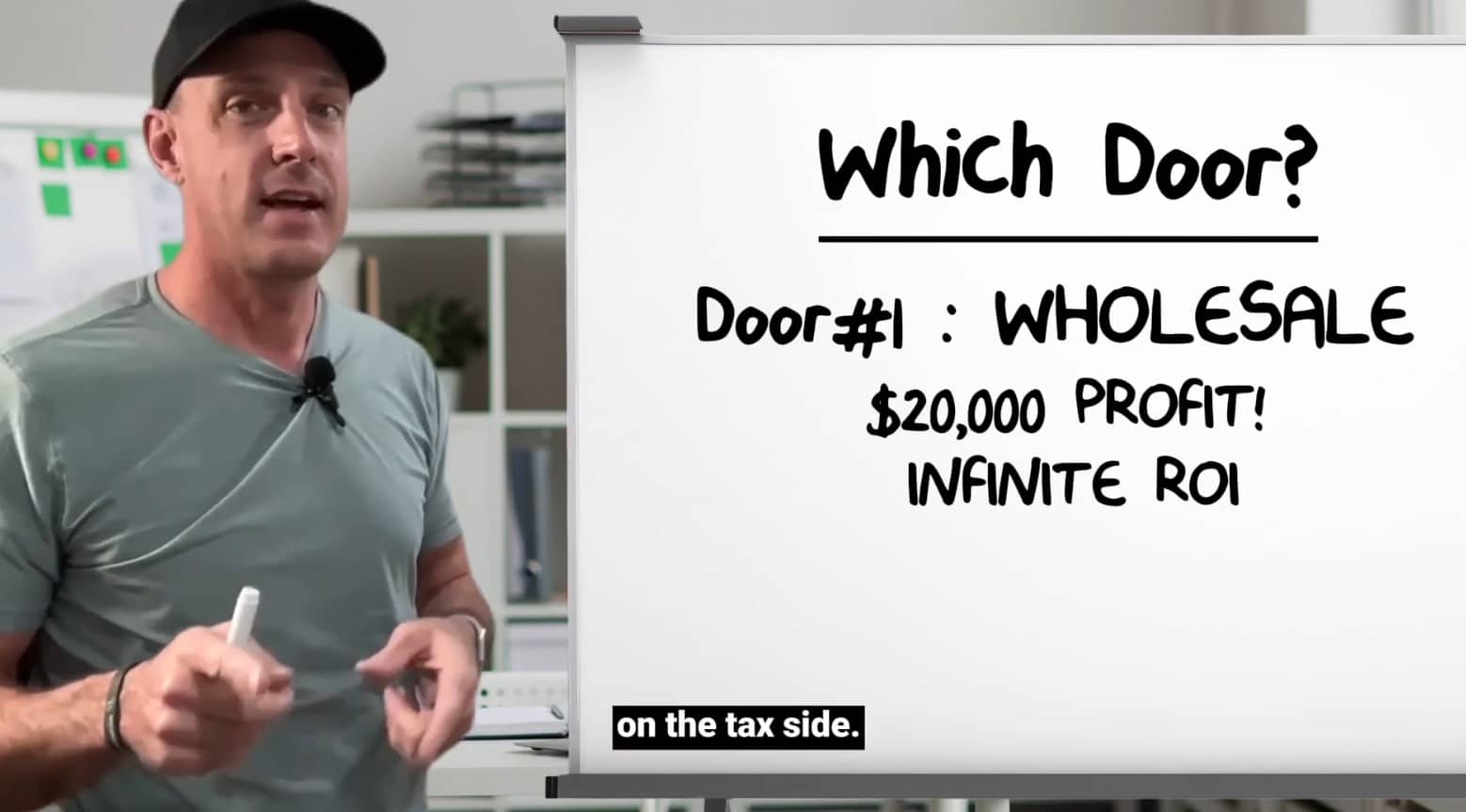

$200,000 property, which door would you choose?

Watch this short video for all the juicy details!

Key Takeaways:

Wholesale:

- $20,000 profit!

- Infinite ROI

- Taxed as ordinary income, pay Uncle Sam

Example: 30% in taxes, approximately $6,000 to IRS

- $14,000 in your Bank account

Flip:

- $40,000 profit!

- 20% DOWN, 80% ROI

- 30% TAX = $12,000

$40,000 – $12,000 TAX = $28,000 Bank

Hold for 5 Years:

- 4% appreciation on rent and equity

- Cash Flow:

- Year 1: $6,000

- Year 2: $6,372

- Year 3: $6,732

- Year 4: $7,092

- Year 5: $7,464

- Total cash flow over 5 years $33,660

- Equity: 4% Appreciation

- Year 1: $208,000

- Year 2: $216,320

- Year 3: $224,972

- Year 4: $233,970

- Year 5: $243,328

- Total equity: $43,328

- Total cash flow + total equity = $76,988 (15.69% ROI)

The IRS tells you how to keep money in your account!

-quick profit, more “penalties”

-long game, more incentives

You need active income to make passive income, all 3 options are great options to help you achieve the goal of passive income.