My family all woke up this morning sick to their stomachs…Literally throwing up…All of them but me.

This experience correlates very well with the announcement of the Tariffs last week.

I have no doubt that many of you started feeling nauseous the more he spoke about not only a 10% tariff but massive tariffs on each and every Country that trades with the US. Maybe some of you vomited all over the TV when you realized just how bad this really could be if implemented for the world.

I was not one of them.

Here’s why:

First and foremost, you need to understand this about me. I only invest in real estate. More specifically, I invest in the markets that I live and work in.

It is not only my passion but also my livelihood.

Real Estate is my retirement plan outside of a few whole life insurance policies. Needless to say, I have put a lot of thought into what would occur if Donald J Trump went through with his promise of implementing Tariffs and how that would impact our business model.

Here is what I have concluded:

Real Estate…Specifically, single-family rental properties in the Chattanooga market will be one of the greatest places to park your capital. Second place is not even remotely close.

In other words, if you have $50,000 or more sitting in your bank account right now as you read this and you are trying to decide how you should invest that money because you are tired of inflation eating away at it…I am going to show you why I am very confident that real estate is the greatest investment you could make with your money as of April 9th, 2025.

Let’s just start with this:

If you knew very little about investing and I showed you these charts, and let’s say that you are someone that is risk adverse and prefers steady and reliable income. Which would you prefer?

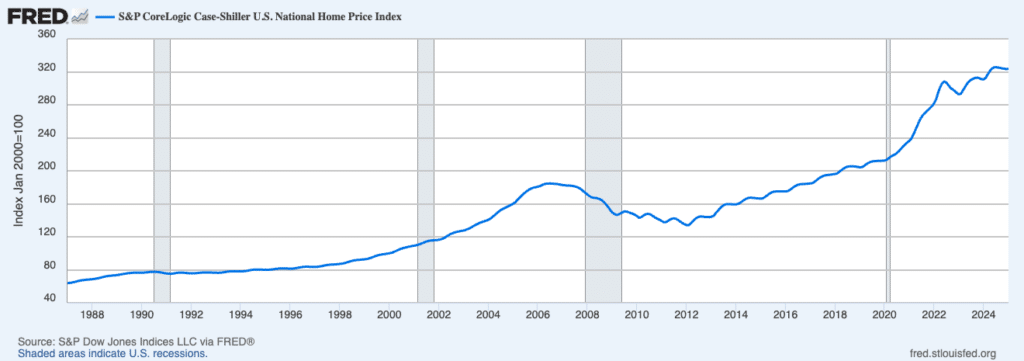

To add some context, the dark grey lines are recessions on the first chart and the blue line are home values.

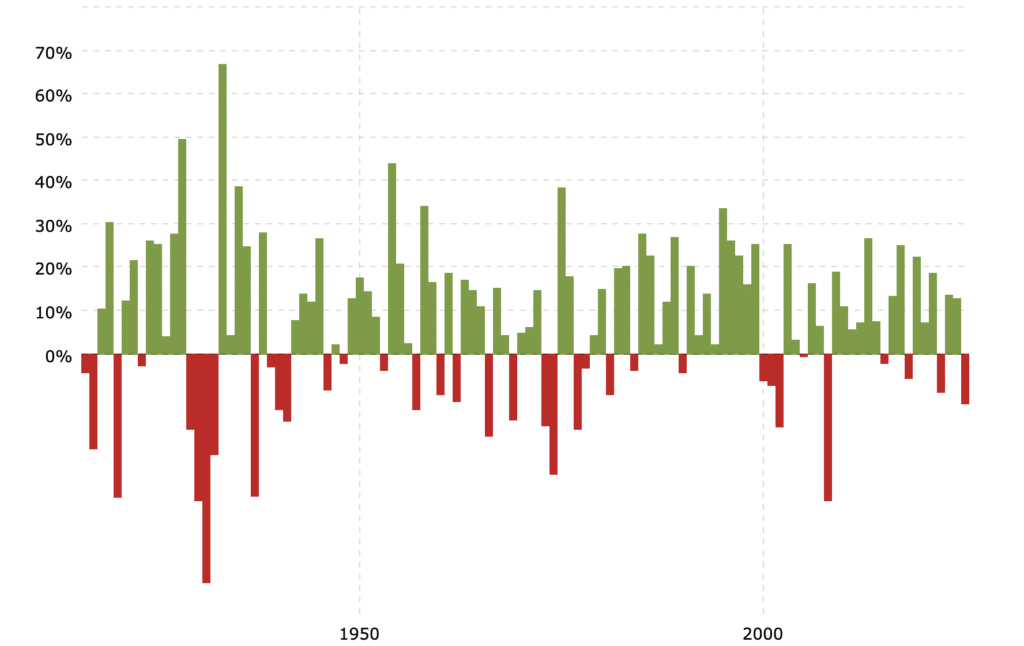

The second chart shows the stock market gains and losses overall for the last 100 years.

https://fred.stlouisfed.org/series/CSUSHPINSA housing steadiness

https://www.macrotrends.net/2622/dow-jones-by-year-historical-annual-returns#google_vignette

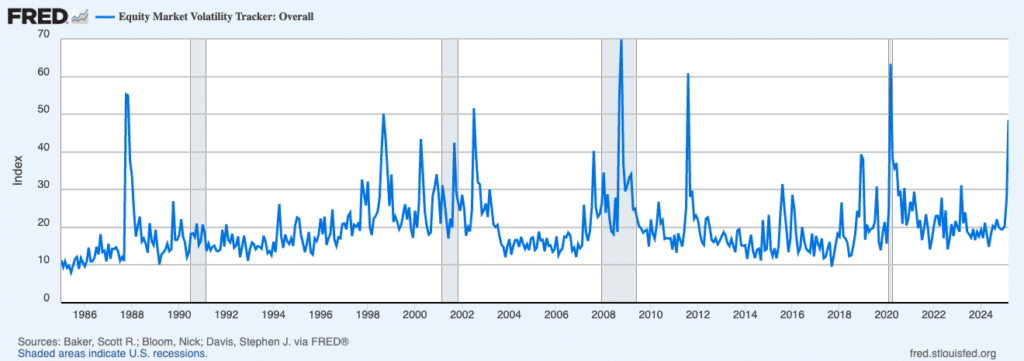

Those of you familiar with stock investing have heard of the VIX chart which tracks what people feel the volatility will be like in the Stock Market in the near future. Does that help you sleep well at night knowing that the market is completely baffled and has no clue how the tariffs will impact world trade and the markets as a whole? Do you feel like you know today what impact tariffs will make on the largest companies in the world that depend on free trade? I am talking about Nike, Apple, Microsoft, Amazon, Walmart, Tesla. Their business model could be completely dismantled this year until they figure out how to adapt.

And the market is freaking out just like they did in March of 2020.

https://fred.stlouisfed.org/series/EMVOVERALLEMV

Do you remember what happened to the real estate market in 2020 when that virus started spreading and the world shut down? After the shock wore off, about 3-4 months later, everyone went out on the largest real estate buying spree this Nation has ever seen! The real estate market thrived during the greatest disrupter of our lifetime! I imagine it will do the same this time around with the tariffs, regardless of how long they last. Especially if the mortgage rates start to drop again.

Speaking of mortgage rates…The last 4 years we have seen record low activity with transactions in real estate all while the population boomed with the open border policies from the prior administration. Everyone has been waiting for the rates to come down in order to afford housing. When poled each year, Americans say they WANT to buy real estate but they need rates to come down to do so.

The reason the rates have been elevated the last 4 years has everything to do with the 10 year treasury yield which has been at elevated levels since the FED increased the fed funds rate in 2022.

The one thing that we have been waiting to happen which will drive down the treasury yield is a RECESSION.

Take a look at what happened to the 10 year treasury yield the days after the tariff announcement. If the stock market continues to take a nose dive, mortgage rates will improve and more demand will come into the market just like Covid.

Real Estate has steadily increased year after year since 2022 as construction has begun to slowly pick up and inventory levels are increasing. If, however, these tariffs are implemented, the cost of building materials will absolutely increase and we all remember what happened when the supply chain was disrupted.

Building once again will slow to a crawl. This will only reduce supply which once again will increase the value of those who are fortunate enough to be holding real estate.

Everyone agrees that tariffs are a tax and will increase the cost of goods. In other words, INFLATION will go up. There is no better asset to own than real estate to hedge against inflation. Why? Because in the US we have the greatest shield against inflation that we use as leverage to purchase real estate. The 30 year mortgage! You are able to lock in your price today that will stay the same for the next 30 years while rental and home prices continue to go up year after year.

I know that 99% of the articles you read about the tariffs will be negative, and if you prefer to keep your blood pressure elevated, by all means, keep watching and reading the news.

If, however, you are looking for the silver lining and you want to stick your money into an asset that will multiply your money, I would highly recommend that you buy real estate in a thriving market with responsible and reliable management in place.

If you are looking to get into real estate investing let’s connect.

| Schedule a quick call with me!With over 15 years of experience in real estate investing and property management, I’ve seen firsthand the incredible opportunities this industry offers. I’d love to share my story with you and explore how we can make real estate investing a successful part of your journey. CHAT WITH BJ  |