Warren Buffett famously said:

“If you don’t find a way to make money while you sleep, you will work until you die.”

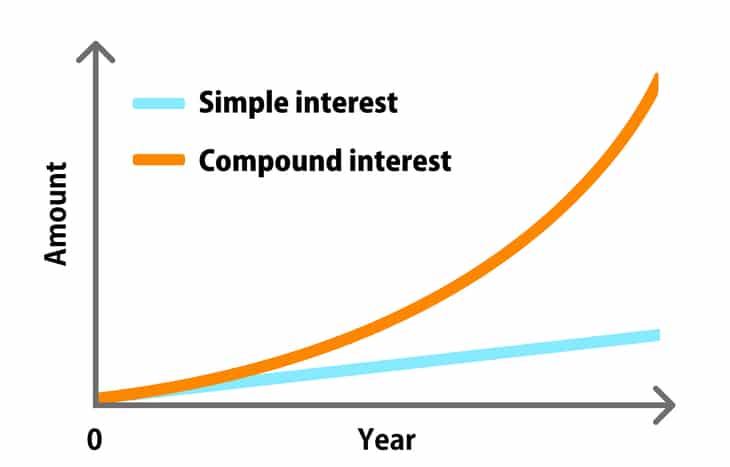

I suspect every single person reading this email has been told and understands that the sooner they invest their money, the sooner compound interest will work its magic and you can one day retire…

Believe it or not, the idea of putting away a portion of your paycheck into the stock market by deferring some of your pay and placing it into the stock market did not become “a thing” until the late 70’s with the introduction of The Revenue Act of 1978.

The Revenue Act of 1978 which said that employees can choose to receive a portion of income as deferred compensation, and created tax structures around it. This was actually created and used primarily by senior executives who wanted to supplement their pensions.

As you can imagine, very few blue-collar workers put their money towards a 401k plan but over time, this has become a tool most people use to save for retirement.

In 2022, According to Ubiquity Retirements and Savings, about 98 percent of employers offer 401(k) matching. Still, the U.S. Bureau of Labor Statistics found that only 51 percent of Americans are investing in a 401(k) plan, even though 68 percent of Americans have access to one.

That is great progress and I am glad that so many Americans are deferring pay now for a bigger payday in the future.

However, most Americans are blindly putting their hard-earned money into investments within a 401k that they have little to no clue about. Not to mention the value fluctuates wildly causing panic and uneasiness that comes from not knowing how those losses could have been avoided.

I watched my parents who saved religiously every month and put as much as they could into their 401k plans and I would watch the mood swings that accompanied the stock market fluctuations and I remember thinking that I guess that was adulthood.

You just hoped and prayed that you put your hard-earned money into the hands of a financial advisor or employer plan who placed them in some mutual funds that hopefully did well and hoped that when you retire there would be more money there than what you initially invested.

Here are the top 5 issues that I have with the “hope and pray” approach to 401k plans…

- Very few people have any clue WHAT they have their money invested in outside of the fact that it is in some index fund or mutual fund tied to their risk tolerance.

- 401k’s are generally tied to index funds which means you are officially tied to the rollercoaster of the market swings. Overall, it tends to average out to around 8-10% over a decade (just hope that you do not need the money during a big downswing in the market).

- Little to no time is spent 1 on 1 with participants in customizing their 401k outside of a few basic risk assessment questions that put you into a few pre-determined buckets of mutual funds.

- 401k plans are tied to thousands of stocks which means you have no control over the outcome of these companies such as who the CEO is, how well they run a business, how they allocate their funds, what decisions their board is making on a yearly basis, etc.

- The tax benefits are only tied to the deferral of tax and reduction on your income for the years you contribute. The interest on earnings also grows tax deferred (but you will still pay taxes once you pull out the money down the road).

In short, most people are investing in a 401k because…let’s be honest, they do not have the time, knowledge, or know how to invest their money anywhere else that they feel comfortable with.

They just do it because they know they should put it SOMEWHERE.

Real Estate:

Let’s take a look at why you should consider investing more of your money into real estate:

- “Ninety percent of all millionaires become so through owning real estate. More money has been made in real estate than in all industrial investments combined. The wise young man or wage earner of today invests his money in real estate.” – Andrew Carnegie

- “Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world.” – Franklin D. Roosevelt

Just like it took decades until the majority of Americans started to utilize the benefits of a 401k not only for the tax benefits but also for the compound interest that occurs over time, I believe that there is a MASSIVE GAP in the education space for real estate that is keeping many from investing the majority of their discretionary income in real estate.

Think about how many stock traders and financial advisors are out there to push you into investing in the stock market compared to the number of people with background and experience that are able to help you invest your money in real estate.

I would venture that the ratio is somewhere around 1,000 to 1.

I am in a unique position in life where I have actually been on both sides of the table. My career began with Edward Jones as a financial advisor and I now operate an investment firm that focuses on helping others to invest responsibly in real estate.

Our goal at Property Rush is to show others how to invest responsibly in real estate by offering “turnkey” investment properties that we have already vetted for the neighborhoods, inspections to confirm condition, licensed contractors to remodel up to our highest standards, lenders who have been vetted by us, and finally, a property manager that will market, screen, place tenants, collect payments, and handle any and all maintenance issues for the entire time you own the property.

Bottom line, from my experience in both financial advising & real estate investing…Here are the top 5 reasons why Real Estate trumps a traditional 401k plan:

- CONTROL. Did you know that you can invest in REAL ESTATE within a SELF-DIRECTED IRA! In addition to this, if you own your own business and can utilize a SEP IRA, you can invest well over the low minimums for individuals and married couples (Upwards of $60,000 annually). *You can also roll over your 401k into this plan!* Just make sure to ask your CPA about how to do this properly!

- Depreciation: This is an additional tax savings you will not get from a standard 401k index fund

- Consistent and reliable income

- Leverage: You can own a home by putting down 10-20% of the purchase price and using the bank for the rest of the funds. Then turn around and have someone else (tenants) make payments to pay down the debt all while your asset is appreciating and you can eventually refinance once the property has appreciated enough to pull out ALL of your initial investment and enjoy an infinite return on your investment.

- Rinse and repeat until you have a portfolio worth millions of dollars that can be passed down to your heirs.

I did not put this on my top 5 but if inflation is a concern of yours (it should be if it is not)…Real Estate is the best hedge that you will find to keep up with inflation (think about the last 3 years of appreciation vs inflation rate). Enough said.