For the last three years I’ve heard the same narrative:

- “The golden era of real estate is over.”

- “Prices are flat.”

- “Rates killed the cash flow in my market.”

- “The ship has sailed.”

The Market Didn’t Get Worse. It got very honest.

Warren Buffett would say that we now can see who was swimming naked when the tide went out…

Well, figuratively speaking, the tide went out in 2022 when the fed drastically raised the rates at the fastest pace I have ever seen in my lifetime and while this hurt temporarily…It was one of the best things that could have happened. (I would argue he was about 18 months too late but hey, better late than never.

The hard truth is Cheap Money Hid Bad Decisions.

On the flip side of this… We see how expensive money reveals those bad decisions immediately which then causes investors to really consider their next purchase.

So now that we are in a period of flat growth for the past several years, what should you be doing differently as a real estate investor?

Let’s think this through together…

Bubble Markets Create Noise. Flat Markets Create Operators.

From 2012–2021, you could buy almost anything and look smart.

- Appreciation covered bad underwriting.

- Cheap debt masked weak cash flow.

- Speculation felt like strategy.

To drive home this point, I have discussed in prior articles about homes we purchased to flip in 2021 that the longer we took to remodel a property, the more money we made because each month the price of a home would go up 2-3%!

That wasn’t investing.

That was momentum.

Now we’re in a different environment:

- ~6-7% interest rates

- Slower price growth

- Buyers more cautious

- Sellers more realistic

Let me show you why that logic misses the point.

1. Rents Don’t Care About Your Sentiment

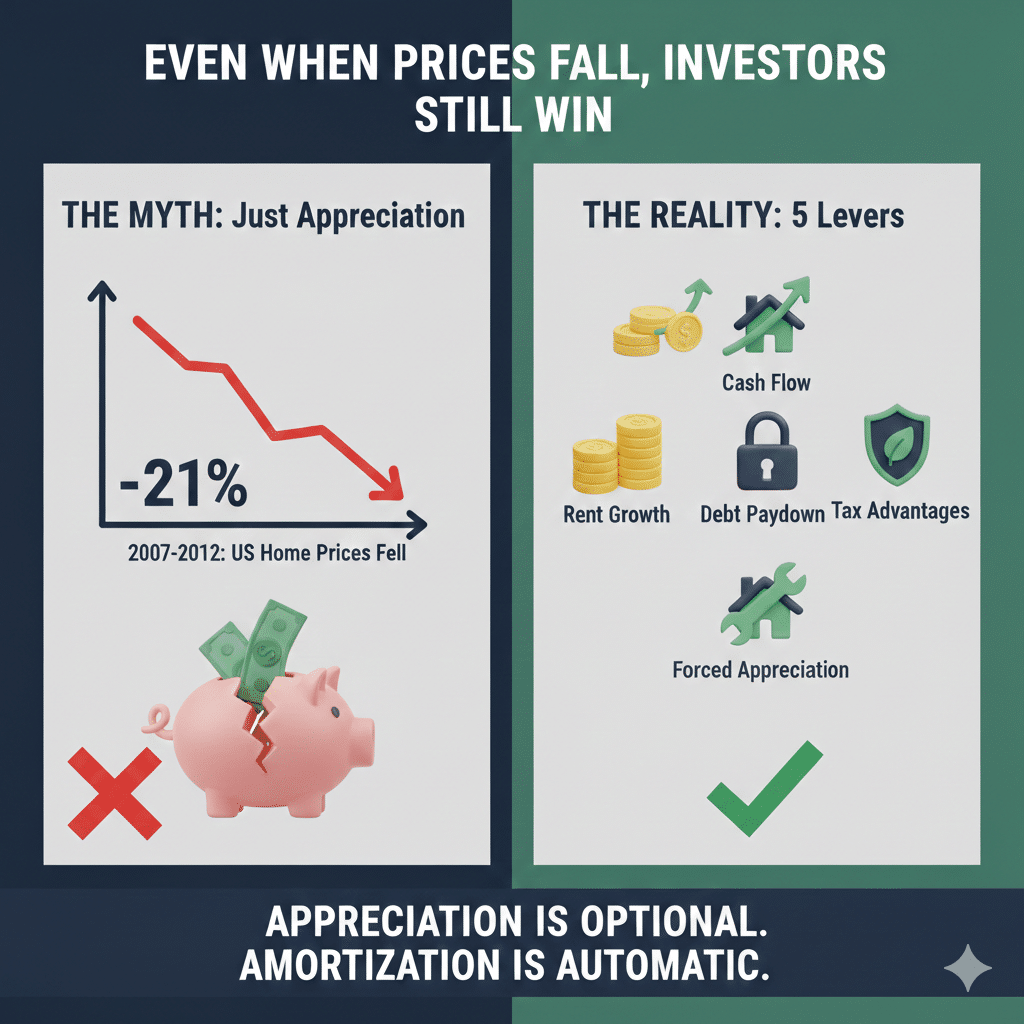

2. Even When Prices Fall, Investors Still Win

Let’s remember something uncomfortable:

From 2007 to 2012, U.S. home prices fell about 21% peak-to-trough.

And yet…

Investors who:

- Bought for cash flow

- Locked in fixed debt

- Had reserves

- Held long term

Still built equity.

Because appreciation is only one lever.

Real estate has five:

- Cash flow

- Rent growth

- Debt paydown

- Tax advantages

- Forced appreciation

Appreciation is optional.

Amortization is automatic.

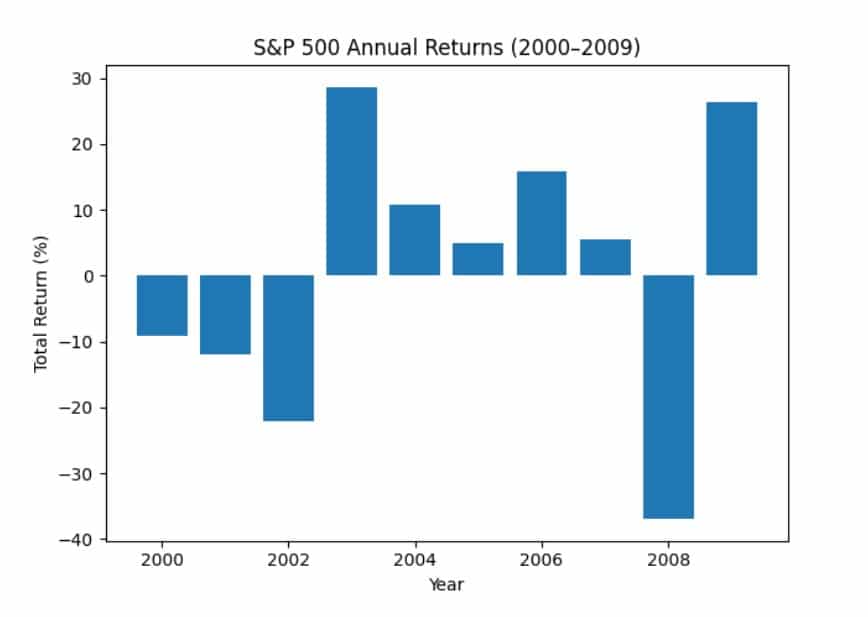

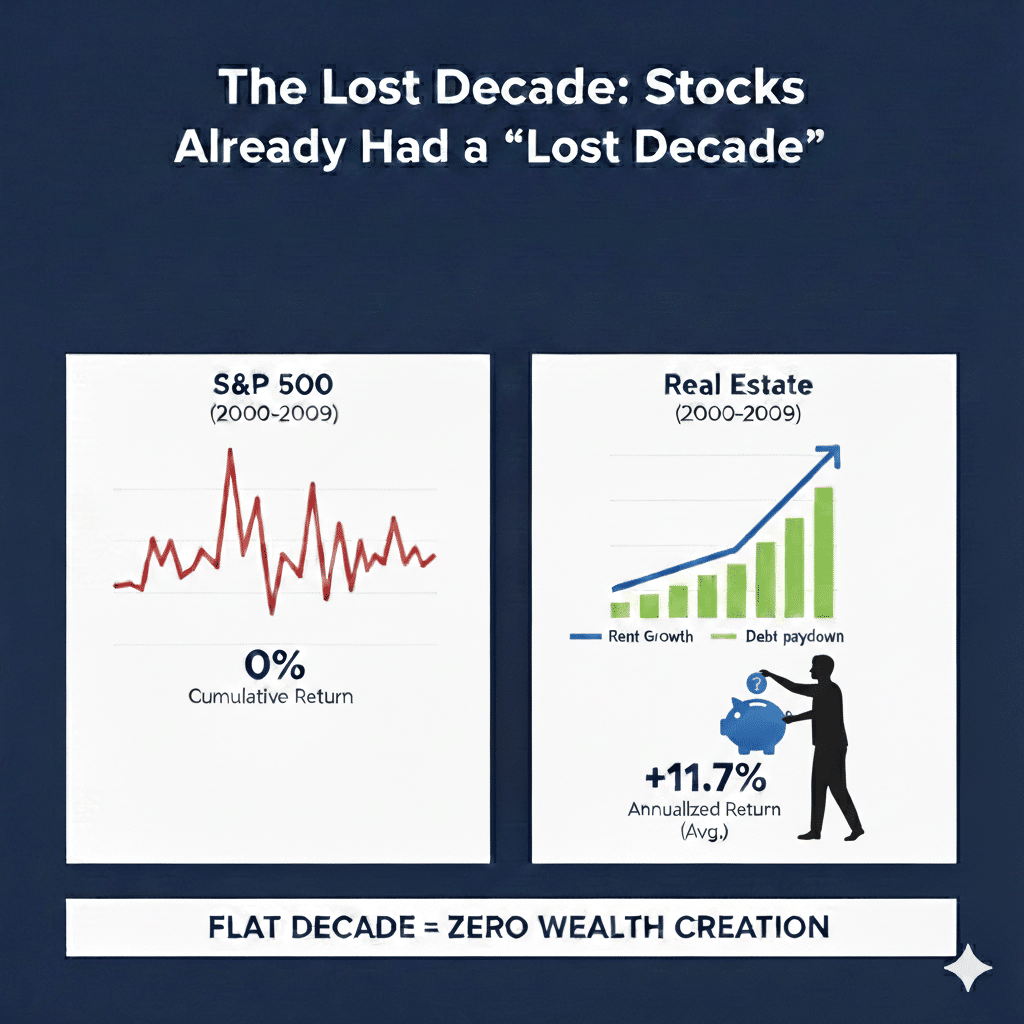

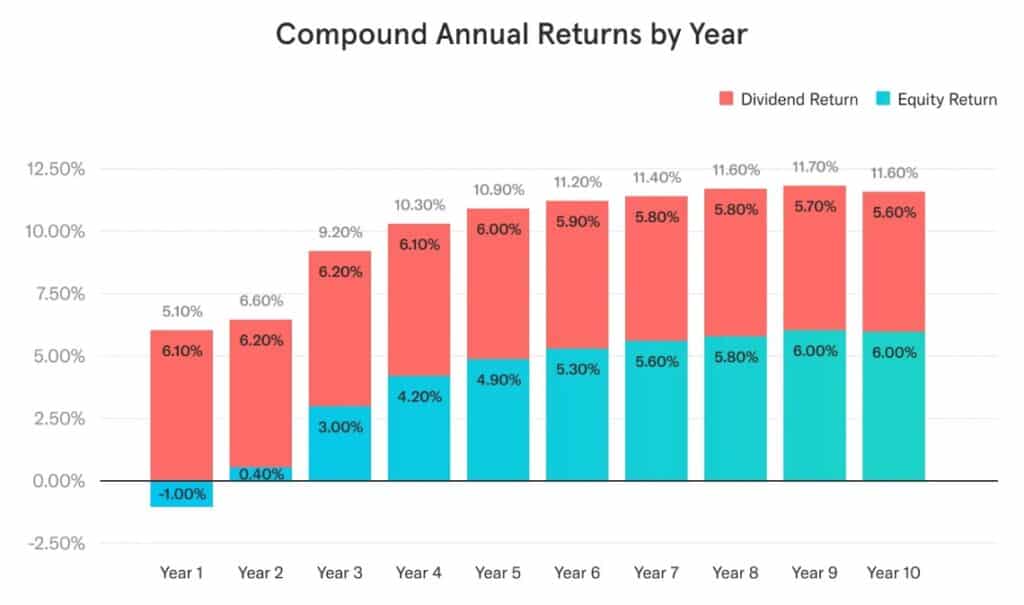

3. The Stock Market ALSO Experienced a “Lost Decade”

From 2000–2009, the S&P 500 delivered roughly flat cumulative returns.

Year-by-year volatility was brutal.

And yet people still built wealth.

How?

- They kept investing.

- They reinvested dividends.

- They didn’t panic.

- They played long-term.

Real estate works the same way.

Flat decade ? zero wealth creation.

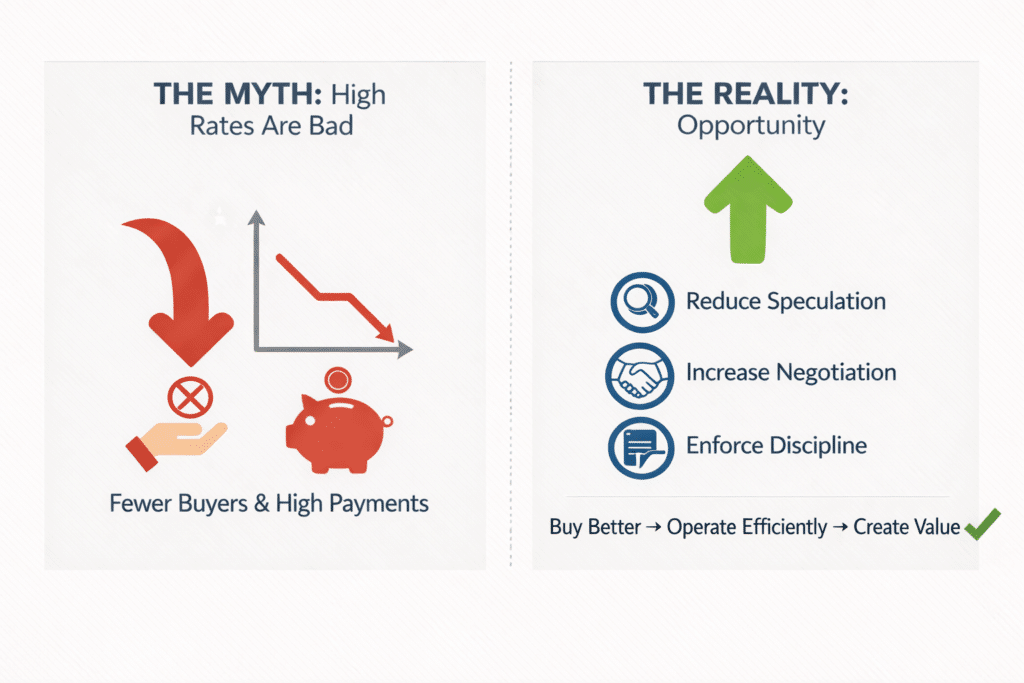

4. Rates are NOT the Issue. Stop Focusing on it!

Everyone is obsessed with rates.

Here’s the truth:

High rates:

- Reduce speculative buyers

- Increase negotiation power

- Force underwriting discipline

You can refinance a rate.

You can’t renegotiate the price you overpaid.

In flat markets:

- You buy better.

- You operate tighter.

- You create value.

- Prices are held in check when rates go up.

Hence, 2022-2026…Thankfully the rates cooled down the rampant price increases that came as a direct result of lower mortgage rates.

That’s where wealth hides.

5. Flat Markets Reward Boring Investors

The investors who win long-term are not flashy.

They:

- Keep reserves.

- Underwrite conservatively.

- Assume 0-2% appreciation.

- Improve properties.

- Raise rents responsibly.

- Hold through cycles.

They treat real estate like a business, not a lottery ticket.

The Chattanooga real estate market is the tortoise market. It is built for the boring investors looking for slow, consistent, steady growth. Similar to our desert tortoise pets that we have at home, if we treat them well and make sure to feed and take care of them, they will continue to grow and in fact outlive us.

They are our spirit animals!

6. The Math That People Ignore

Let’s say you buy a $300,000 property.

Even if it never appreciates:

- The tenant pays down your mortgage.

- Rents rise over time.

- Your payment stays fixed (if you locked it).

- Inflation erodes your debt.

In 10–15 years:

- You own dramatically more equity.

- Your income likely improved.

- Your debt burden shrank in real terms.

You didn’t need a bubble.

You needed time.

Why This Matters Right Now

Today feels uncomfortable.

That’s exactly why opportunity exists.

When everyone believes:

- “The best years are behind us”

- “Prices will be flat forever”

- “Wait for a crash”

That’s usually when disciplined investors quietly accumulate.

Wealth is rarely built during euphoria.

It’s built during doubt.

The Real Question

If your time horizon is 2 years, real estate might feel dead.

If your time horizon is 20 years, it’s just getting started.

Flat markets make people rich.

Bubble markets make people loud.

And I’d rather be rich than loud.

With over 15 years of experience in real estate investing and property management, I’ve seen firsthand the incredible opportunities this industry offers. I’d love to share my story with you and explore how we can make real estate investing a successful part of your journey.

BJ