If you’re comparing real estate to the stock market, chances are you’re only looking at one or two numbers — equity growth or annual cash flow. That’s like judging a stock only by its dividend.

What really sets real estate apart, and why more investors are beginning to choose it over Wall Street, is simple: It doesn’t just pay you one way. It pays you in five different ways, all working together.

Let me show you what this actually looks like with a property in Chattanooga that we currently manage for one of our investors:

Chattanooga Duplex

- Purchased in 2023 for $300,000

- Today’s value (2025): $325,000

At first glance, that looks like a $25,000 gain in equity in under 2 years. Nice, right? But that’s only a small part of the bigger picture…

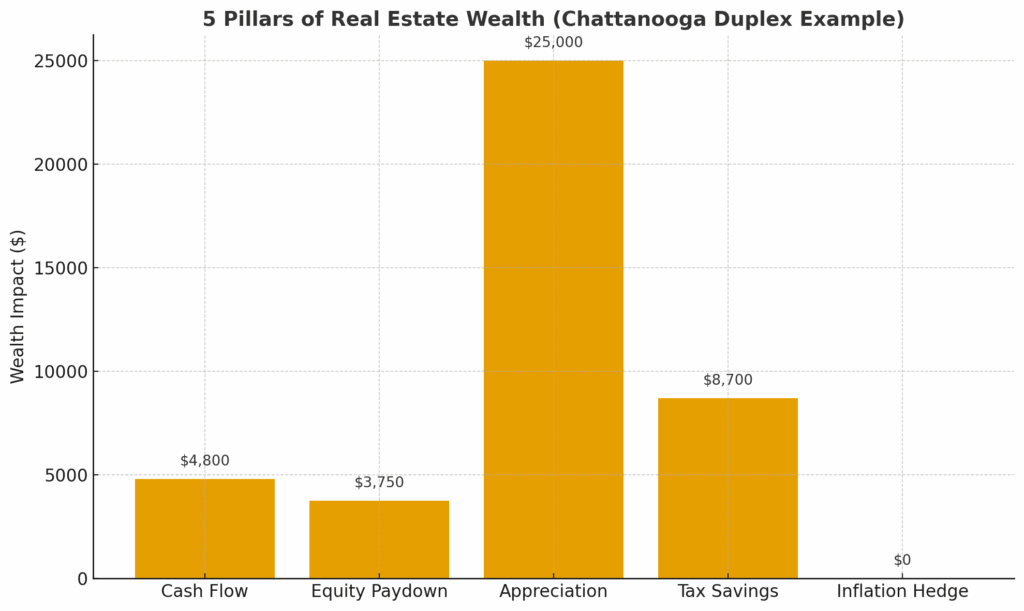

The 5 Pillars of Real Estate Wealth

1. Cash Flow

Each side of the duplex rents for ~$1,400. That’s $2,800 per month, or $33,600/year in rental income.

- After mortgage (20% downpayment), taxes, insurance, and maintenance, let’s say net cash flow is $400/month ($4,800/year).

- This is income in your pocket every month — something stocks don’t give unless they’re dividend-paying.

2. Equity Paydown

Tenants are effectively buying the property for you.

- On a $240,000 loan (80% of $300k), your principal is being paid down roughly $3,500–$4,000 per year in the early years.

- That’s forced savings — your wealth growing without you doing anything.

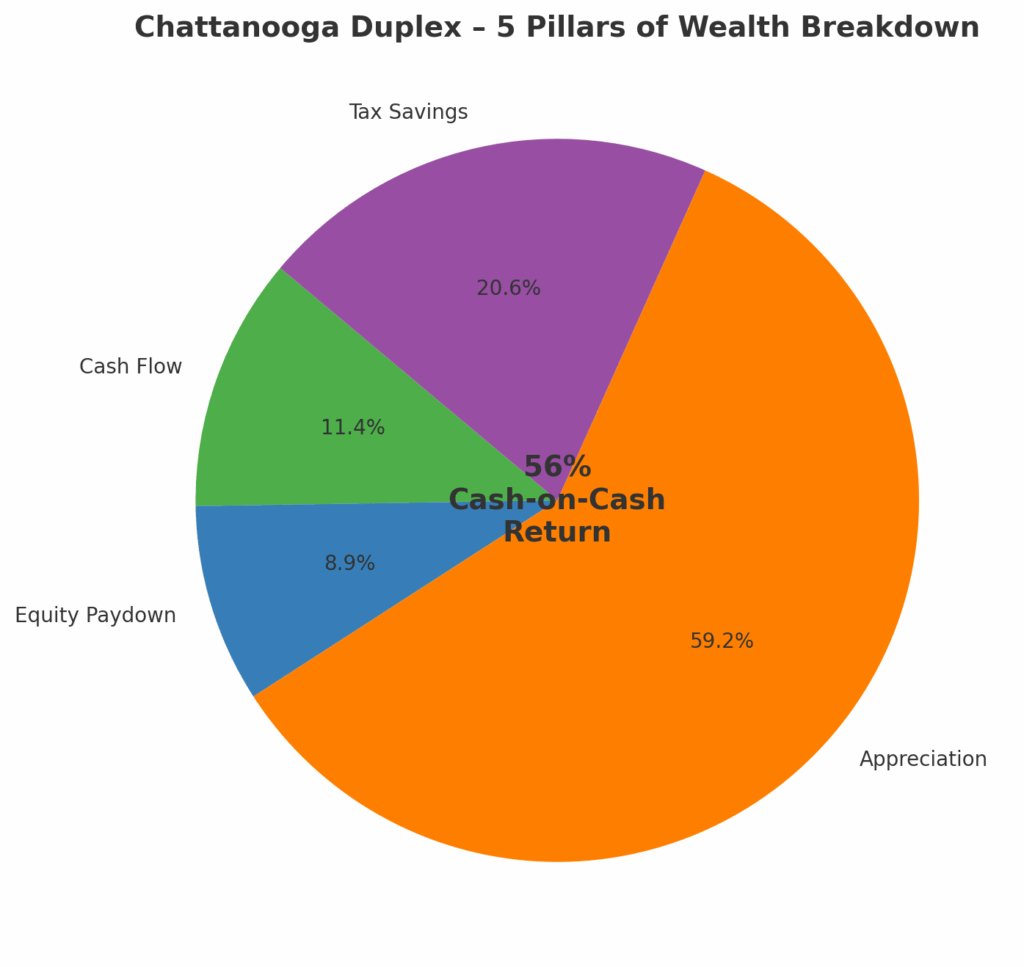

3. Appreciation

The duplex is already worth $325,000, a gain of $25,000 in under 2 years.

- That’s an 8.3% return on the full purchase price.

- But remember — if you only put down 20% ($60,000), your actual return on cash invested is much higher… As in 56% cash on cash return!

4. Tax Benefits

Here’s where it gets fun.

- Depreciation: On a $300k property, ~80% ($240k) can be depreciated over 27.5 years. That’s roughly $8,700/year in paper write-offs.

- Combine that with expenses (insurance, repairs, interest), and you often wipe out much of your taxable rental income.

- Translation: you get real cash flow, but the IRS often sees little to no taxable income.

- Oh and by the way, you may have heard about the new tax laws that allow for 100% tax depreciation taken in 1 year with a cost segregation study…Talk to your CPA about the details but if you want to supercharge tax savings in a given year, it is tough to beat this strategy!

5. Hedge Against Inflation

- As prices rise, rents rise too. That $1,400/unit rent today could be $1,600 in just a few years.

- Meanwhile, your 30-year mortgage payment stays fixed.

- Inflation eats away at the value of your debt while increasing the value of your asset.

The Full Picture

Here’s what that one duplex delivered in Year 1–2:

- Cash Flow: +$4,800

- Equity Paydown: +$3,750

- Appreciation: +$25,000

- Tax Savings via Depreciation: +$8,700 (paper shield, but very real)

Inflation Hedge: Locked-in fixed mortgage while rents trend upward.

Total Wealth Impact in 2 years: $42,000+ (and growing).

And that’s just one property. Imagine scaling to 5, 10, 20 doors over 5–10 years.

The Takeaway

Stocks might go up or down. Crypto might moonshot or crash. But real estate quietly works for you in five different ways at once. That’s why we believe it’s the best long-term wealth builder hands down.

If you’re ready to see deals in Chattanooga & North Georgia that check all 5 boxes, click the link below!