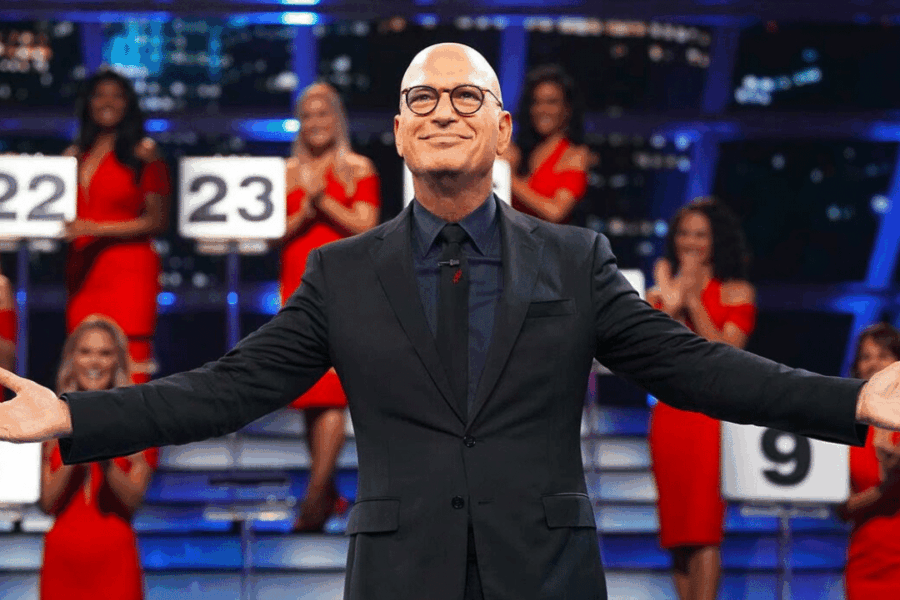

Remember the TV Show “Deal or no Deal”?

If you never watched it, basically they put 26 pretty girls on stage each holding a briefcase with a number written on a card inside of them between $1 & $1,000,000.

Over the course of the game, the contestant eliminates cases from the game, periodically being presented with a “deal” from The Banker to take a cash amount to quit the game. Should the contestant refuse every deal, they are given the chance to trade the case they chose at the outset for the only one left in play at the time; they then win the amount in the selected case.

My kids and I recently played this game at Main Event and I enjoyed watching each of their personalities and sheer excitement as they stressed over the decision to take a “sure number” from the banker that was often conservative but reasonable given the potential statistics that a higher number would be chosen which of course would be bad for the bank and great for the contestant.

I quickly learned that my 12-year-old son may just have a gambling problem and he will go for broke 10/10 times no matter how slim his chances are of making more than what the banker offered, whereas my 13-year-old daughter was the opposite. She would take her time and be so sad anytime she rejected the banker offer and then later realize her suitcase that she chose was lower than what she could have gotten had she taken the offer from the bank. In later games that we played I noticed she would more often than not choose to take the bankers offer and be perfectly fine with living with the results even if she gave up her chance to hit a home run and win that $1,000,000 prize that statistically was much more difficult to obtain.

Which person do you resonate with most?

Alex Hormozi said this:

“The majority of millionaires are made in real estate.

The majority of billionaires are made in private equities.

Real estate is the sure thing. Business is the big thing”.

I have yet to meet a millionaire who did not own real estate. Even if it was just their personal home…Why do you think that is? It is simply because the ROI in real estate is unlike any other investment in the world and the more you learn about real estate, the more you want to put every dollar INTO real estate.

WHY?

It’s the sure thing to wealth creation.

My son on the other hand, and maybe a few of you reading this, might be thinking way past the sure thing. And you know what, those people go for broke but IF they hit that lucky opportunity, they become the household names we all talk about every day like Jeff Bezos, Elon Musk, Steve Jobs, Bill Gates, etc. And funny enough, all of these men I just rattled off are now buying up massive amounts of real estate to provide affordable housing for their employees.

Coincidence?

Did you know that the largest private owner of farmland in the world is Bill Gates?

Did you know that Apple supported projects are creating new homes for close to 20,000 individuals, and another nearly 24,000 people who were at risk of losing their homes have been able to stay housed?

Amazon’s Housing Equity Fund is providing more than $5 billion in below-market loans and grants to preserve and create more than 35,000 affordable homes nearby it’s headquarters.

Businesses now are buying up real estate and offering loans to their employees to attract them to work with them. If Trillion & Billion dollar companies are pumping their money into real estate, do you think it might be a good idea to do the same? (Maybe not a billion dollars but how about $50,000 dollars of your savings?)

Let me ask you this.

How much do you think the average median home cost will be in your area in 2034?

Keep in mind that since 1976 the average return on housing every 5 years is 26%…So if that trend continues, a median home price today of $300,000 for example would be $378,000 in 5 years…And $476,280 in 10 years.

So you could put $75,000 down today to own an asset worth $300,000 and in 10 years will be worth $476,280.

Take this one step further and then LEASE a property out so that someone else pays off your loan and you get the leftover cash each month while also enjoying the tax write-offs and you can see how compounding money begins to really take off.

Here is one of our featured listings that we just wrapped up and placed on the rental market. If you are interested in investing in a sure thing.

738 Roberta Dr, Rossville, GA, 30741

$219,500 purchase

$1,900 rent

New top to bottom (windows, AC, paint, kitchen,bathrooms,fixtures, etc)

Low taxes & insurance costs

TURNKEY management in place.

If you are looking to hit the jackpot and become a billionaire in business,

we cannot help you.

On the other hand, if you are looking for a sure

“DEAL” that will generate a consistent steady and boring income…