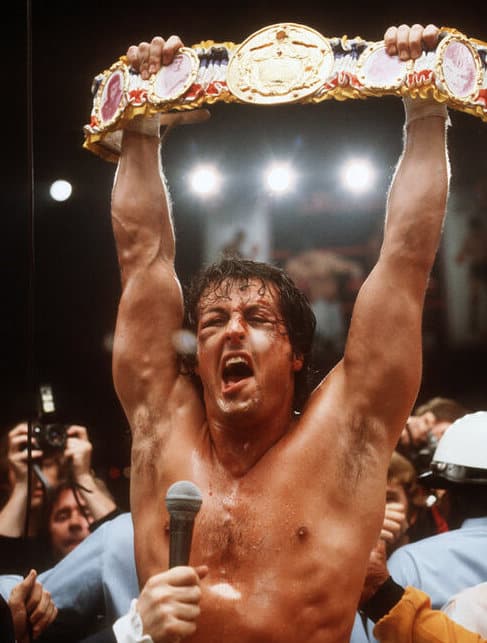

Americans love comeback stories. Growing up I remember watching the Rocky movie with my dad. He had watched that movie a dozen times and yet he still got emotional watching Rocky pick himself up after being knocked down and eventually winning the fight.

The real estate market has been in a recession since the summer of 2022. And it is due for a comeback.

How can real estate be in a recession with prices at all-time highs still?

Believe it or not the recession everyone was warning you about actually DID occur…it just decimated VOLUME not PRICES.

This of course had massive implications for anyone in the real estate sector (lenders, appraisers, realtors, inspectors, investors).

Many of them saw their incomes drop 60-70%!

As usual, the recession just looked completely different from the prior recession…so everyone asked as if it was a foregone conclusion the question “When do you think home prices will come down?”

I think 2023 answered that for everyone.

If 8% rates couldn’t bring them down…after a global pandemic also could not take them down…looks like prices are here to stay.

Funny enough, I recently shared my 2024 market predictions for 2024 BEFORE this past week where we saw the Fed announce multiple rate cuts that will occur in 2024, core inflation down to roughly 3%, jobless claims increase and the result was predictable: 1% DROP in 30 days with mortgage rates. BANANAS!

For 2024, I predicted demand would pick up once rates dropped and it would far outpace supply but the prices would not have room to go up another 20% due to the rates and affordability (thank goodness).

I did not however anticipate it happening as quickly as it did.

Historic booms and busts in the economy generally occur because a perfect storm is created.

2008: credit crisis, short-term adjustable loans that were given to unqualified buyers that were susceptible to interest rate fluctuations along with massive greed and overbuilding by contractors all collided and the result was ugly.

Result: one of the most unhealthy markets for sellers.

2021: we pumped historic amounts of capital into the market, dropped rates to zero, we were already severely behind with supply to meet demand, and covid restrictions screwed up supply chain and production causing a severe drought of inventory.

Result: one of the most unhealthy markets for buyers.

2022 the Fed crashed the party and hit it with a flurry of body shots. real estate was down for the count similar to a boxing match or a Rocky movie. Rocky was stumbling and drowsy but against all odds and to the surprise of the fed nobody let go of their 3% mortgages which kept home prices stable or even slightly lower for 18 months.

And then, just like we have been talking about for the past month, mortgage applications have increased week over week for the last 5 weeks ever since rates started crashing which if you pay close attention to the data tells you that this spring and summer selling season could look similar to the 2021 market for sellers.

So why is this important and how does it impact you?

Several weeks ago I mentioned we have been capitalizing on this very small window of leverage that occurs usually in the winter months. Very few people are competing against us for homes on the market because most people buy and sell in the spring and summer.

For this reason, we work very hard to buy inventory when it’s on sale in the fall and winter months so we are not paying a premium in the summer and competing against a handful of buyers on every purchase.

Our inventory of turnkey since last week is down 80%. We are staying disciplined with our buy box and strategy so even with the soft market the last month, demand for solid income properties is outpacing supply.

We only have two properties coming to market in the next 30 days and then we are completely out of inventory.

If you are looking to buy a home either for yourself or as an investment and you want to buy low so you can sell high down the road (that’s the main goal of the game here)…All I can say is the data is telling you a resurgence in demand is coming and if the rates drop like just about everyone anticipates for 2024, throw speculation out the window, it will be a full-blown seller market again.

If you are serious about purchasing one of our turnkey investments, you can simply reply to this email.

Or if you are in the beginning stages and would like to learn more about real estate and how you can implement real estate as a part of your wealth planning strategy,

Schedule a call here.

Let me tell you something you already know. The world ain’t all sunshine and rainbows. It is a very mean and nasty place and it will beat you to your knees and keep you there permanently if you let it. You, me, or nobody is gonna hit as hard as life. But it ain’t how hard you hit; it’s about how hard you can get hit, and keep moving forward. How much you can take, and keep moving forward. That’s how winning is done.